All Categories

Featured

The most effective selection for any type of individual must be based upon their present circumstances, tax obligation situation, and economic goals. Fixed annuities. The cash from an acquired annuity can be paid out as a single swelling amount, which becomes taxed in the year it is received - Flexible premium annuities. The disadvantage to this alternative is that the profits in the contract are dispersed first, which are tired as common earnings

If you don't have an instant need for the money from an acquired annuity, you might choose to roll it right into an additional annuity you regulate. Through a 1035 exchange, you can route the life insurance provider to transfer the cash from your acquired annuity right into a new annuity you develop. If the acquired annuity was originally established inside an IRA, you might exchange it for a certified annuity inside your own Individual retirement account.

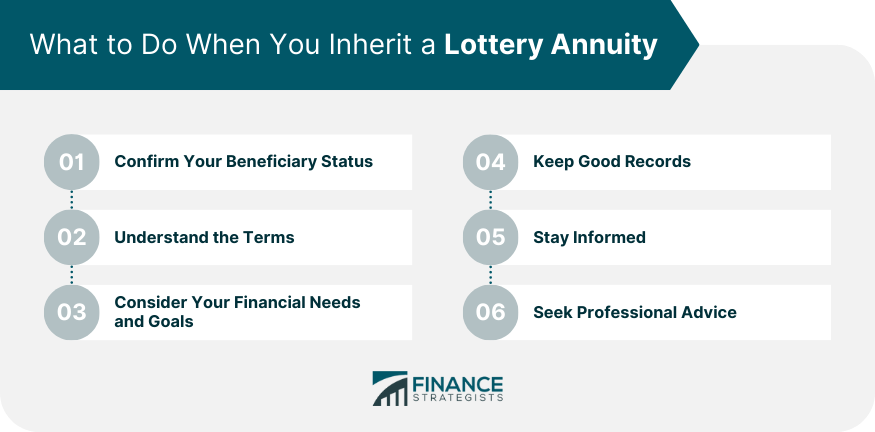

Nonetheless, it is normally best to do so immediately. This will ensure that the payments are received without delay which any issues can be taken care of promptly. Annuity beneficiaries can be objected to under particular circumstances, such as conflicts over the legitimacy of the recipient designation or cases of excessive influence. Seek advice from lawful experts for support

in disputed recipient scenarios (Annuity income stream). An annuity survivor benefit pays a set amount to your beneficiaries when you pass away. This is different from life insurance policy, which pays a survivor benefit based upon the face worth of your policy. With an annuity, you are basically purchasing your own life, and the fatality advantage is meant to cover any type of outstanding prices or debts you may have. Beneficiaries get settlements for the term defined in the annuity agreement, which might be a fixed duration or forever. The timeframe for moneying in an annuity differs, but it often falls in between 1 and 10 years, relying on contract terms and state regulations. If a beneficiary is crippled, a lawful guardian or someone with power of lawyer will manage and receive the annuity settlements on their behalf. Joint and recipient annuities are both types of annuities that can prevent probate.

Latest Posts

Breaking Down Pros And Cons Of Fixed Annuity And Variable Annuity A Comprehensive Guide to Investment Choices Defining the Right Financial Strategy Advantages and Disadvantages of Deferred Annuity Vs

Analyzing Strategic Retirement Planning Everything You Need to Know About Financial Strategies Defining Fixed Vs Variable Annuity Pros Cons Pros and Cons of Fixed Index Annuity Vs Variable Annuity Why

Understanding Annuity Fixed Vs Variable Everything You Need to Know About Fixed Vs Variable Annuities Breaking Down the Basics of Investment Plans Pros and Cons of Annuities Fixed Vs Variable Why Fixe

More

Latest Posts