All Categories

Featured

Table of Contents

When you make rate of interest in an annuity, you normally do not require to report those earnings and pay revenue tax obligation on the earnings every year. Growth in your annuity is insulated from individual income tax obligations.

While this is an introduction of annuity taxes, consult a tax specialist prior to you make any type of choices. Multi-year guaranteed annuities. When you have an annuity, there are a variety of details that can impact the taxation of withdrawals and earnings settlements you obtain. If you put pre-tax cash right into an individual retired life account (INDIVIDUAL RETIREMENT ACCOUNT) or 401(k), you pay taxes on withdrawals, and this holds true if you fund an annuity with pre-tax cash

If you have at the very least $10,000 of revenues in your annuity, the whole $10,000 is dealt with as earnings, and would generally be taxed as regular income. After you wear down the revenues in your account, you receive a tax-free return of your original round figure. If you convert your funds into an ensured stream of earnings payments by annuitizing, those settlements are split right into taxed sections and tax-free parts.

Each settlement returns a part of the cash that has already been taxed and a section of interest, which is taxable. For instance, if you get $1,000 monthly, $800 of each payment may be tax-free, while the continuing to be $200 is taxed income. Eventually, if you outlast your statistically figured out life span, the whole amount of each payment might end up being taxed.

Given that the annuity would have been funded with after-tax cash, you would certainly not owe tax obligations on this when taken out. Given that it is identified as a Roth, you can likewise potentially make tax-free withdrawals of the growth from your account. To do so, you should follow a number of IRS guidelines. As a whole, you have to wait up until a minimum of age 59 1/2 to withdraw revenues from your account, and your Roth must be open for at the very least five years.

Still, the various other features of an annuity may exceed income tax obligation treatment. Annuities can be tools for postponing and taking care of taxes.

Inherited Annuity Income Stream tax liability

If there are any type of penalties for underreporting the income, you may be able to request a waiver of penalties, however the passion generally can not be forgoed. You may be able to prepare a layaway plan with the internal revenue service (Structured annuities). As Critter-3 said, a regional expert may be able to help with this, yet that would likely cause a little extra expenditure

The initial annuity contract owner must consist of a survivor benefit arrangement and name a beneficiary - Annuity death benefits. There are various tax consequences for spouses vs non-spouse recipients. Any type of beneficiary can pick to take an one-time lump-sum payout, nonetheless, this includes a heavy tax problem. Annuity recipients are not limited to people.

Fixed-Period Annuity A fixed-period, or period-certain, annuity ensures settlements to you for a specific length of time. Life Annuity As the name recommends, a life annuity guarantees you repayments for the remainder of your life.

Is an inherited Joint And Survivor Annuities taxable

If your agreement consists of a fatality advantage, continuing to be annuity settlements are paid to your recipient in either a swelling sum or a series of repayments. You can choose one person to receive all the available funds or a number of people to get a percent of staying funds. You can also pick a nonprofit organization as your recipient, or a trust fund developed as component of your estate strategy.

Doing so permits you to maintain the exact same options as the initial owner, including the annuity's tax-deferred condition. Non-spouses can likewise inherit annuity payments.

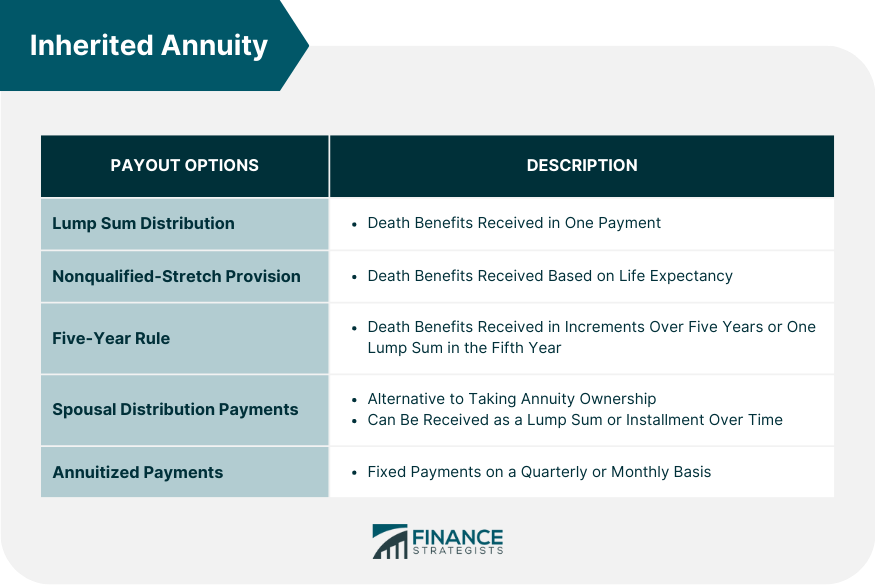

There are three main ways recipients can obtain inherited annuity payments. Lump-Sum Distribution A lump-sum distribution allows the beneficiary to get the contract's entire remaining value as a solitary payment. Nonqualified-Stretch Arrangement This annuity contract condition permits a recipient to obtain payments for the rest of his or her life.

In this instance, tax obligations are owed on the entire difference in between what the original owner paid for the annuity and the fatality advantage. The lump sum is tired at common income tax rates.

Spreading out payments out over a longer period is one means to avoid a big tax bite. If you make withdrawals over a five-year duration, you will certainly owe tax obligations only on the raised value of the section that is taken out in that year. It is also less most likely to press you right into a much higher tax obligation brace.

Joint And Survivor Annuities inheritance and taxes explained

This provides the least tax exposure yet also takes the lengthiest time to get all the money. Period certain annuities. If you have actually inherited an annuity, you frequently have to make a decision concerning your survivor benefit rapidly. Decisions about how you desire to obtain the cash are often last and can't be changed later on

An inherited annuity is a monetary item that permits the recipient of an annuity contract to continue receiving repayments after the annuitant's fatality. Inherited annuities are usually utilized to give earnings for loved ones after the fatality of the primary income producer in a family. There are 2 kinds of acquired annuities: Immediate acquired annuities start paying out as soon as possible.

What taxes are due on inherited Retirement Annuities

Deferred inherited annuities enable the beneficiary to wait up until a later date to begin obtaining repayments. The finest thing to do with an inherited annuity depends on your financial situation and needs.

It is very important to speak with a monetary consultant before making any choices about an acquired annuity, as they can aid you determine what is ideal for your individual circumstances. There are a few risks to take into consideration prior to investing in an acquired annuity. You ought to recognize that the federal government does not ensure acquired annuities like other retired life items.

Annuity Income Riders and inheritance tax

Second, inherited annuities are typically complicated financial items, making them difficult to comprehend. There is always the danger that the value of the annuity could go down, which would certainly reduce the quantity of money you receive in repayments.

Table of Contents

Latest Posts

Breaking Down Pros And Cons Of Fixed Annuity And Variable Annuity A Comprehensive Guide to Investment Choices Defining the Right Financial Strategy Advantages and Disadvantages of Deferred Annuity Vs

Analyzing Strategic Retirement Planning Everything You Need to Know About Financial Strategies Defining Fixed Vs Variable Annuity Pros Cons Pros and Cons of Fixed Index Annuity Vs Variable Annuity Why

Understanding Annuity Fixed Vs Variable Everything You Need to Know About Fixed Vs Variable Annuities Breaking Down the Basics of Investment Plans Pros and Cons of Annuities Fixed Vs Variable Why Fixe

More

Latest Posts